What Are the Current Federal Tax Brackets for 2023 (for filing in 2024)?) TurboTax Tip: There are different tax rate schedules for long-term capital gains than for other income. Head of Household If taxable income is over: Married Filing Separately If taxable income is over: Married Filing Jointly or Qualifying Widow (Widower) If taxable income is over: What Are the Current Tax Brackets for 2022 (for filing in 2023)? In many countries, including the United States, tax brackets are progressive, which means the more you earn, the higher your tax rate will be. These tax brackets determine how much you’ll pay on your taxable income for that year.Įach year, tax brackets are adjusted based on inflation. What Are Tax Brackets?Įach year, the federal government sets tax brackets that include unique tax rates for different levels of income that individuals use when filing their taxes. Use the tables below to find your 20 tax brackets. Each year, the tax brackets are adjusted upward effectively reducing the amount of tax that is paid on a specific amount of taxable income.As your taxable income increases, the percentage of tax you pay on your income can increase if you move into a higher tax bracket.

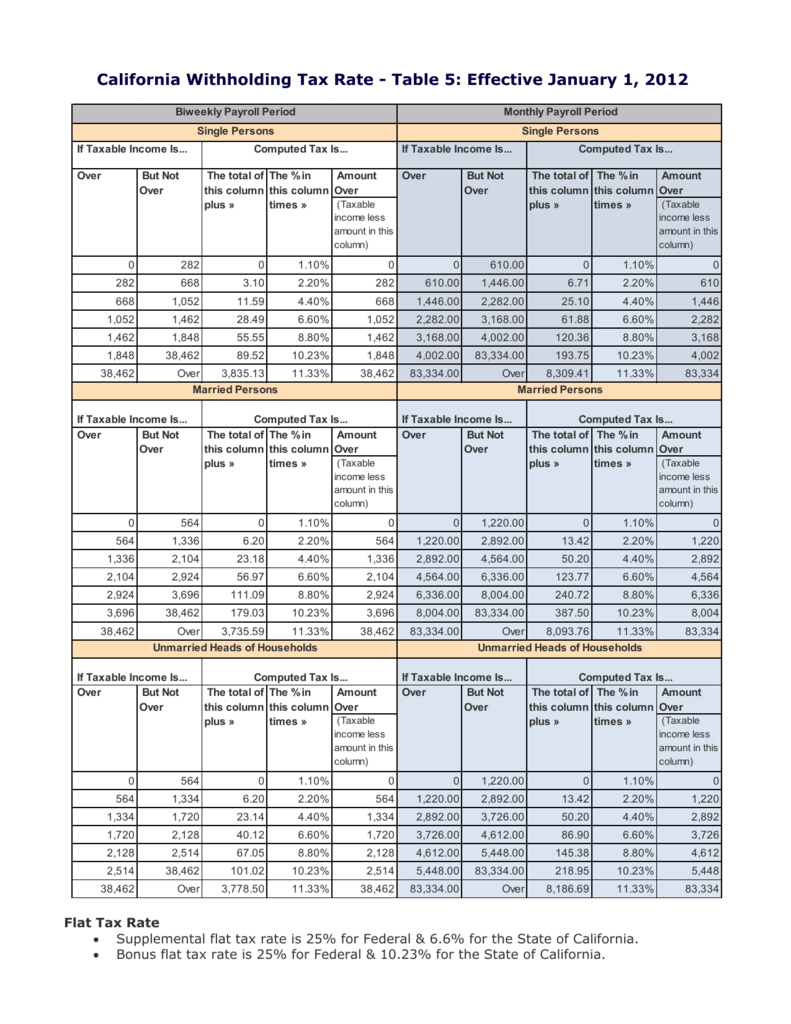

There are different tax rate schedules based on your filing status, with seven different tax rates for each filing status in 20.Tax rate schedules can help you estimate the amount of tax that you will owe when you prepare your taxes.Determine if the employee's gross annual wages are less than or equal to the amount shown in the Low Income Exemption Table below.Withholding Formula >26 < to obtain the gross annual wages. If the employee is using a W-4 in lieu of the California state DE-4, the information for the Additional Exemptions Claimed field should be notated on the W-4. If no exemptions are claimed, enter 00.ĭetermine the Additional Exemptions Claimed field as follows:įirst and Second Positions - Enter the number of allowances claimed in Item 2 of the DE-4.

Second and Third Positions - Enter the total number of regular allowances claimed in Item 1 of the DE-4.

Enter M (married), S (single), or H (head of household). S, M, H / Number of Regular Allowances / Number of Allowancesĭetermine the Total Number Of Allowances Claimed field as follows:įirst Position - Enter the employee's marital status indicated on the allowance certificate.

0 kommentar(er)

0 kommentar(er)